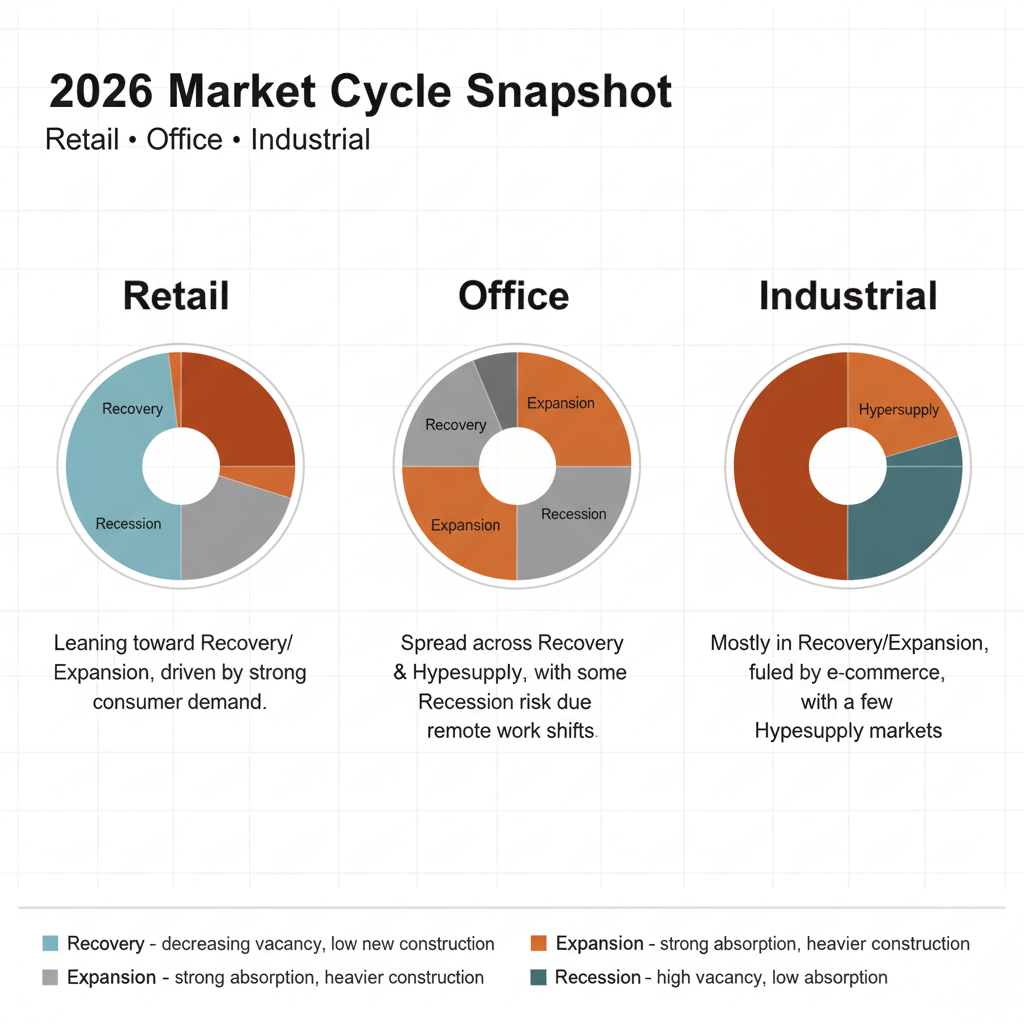

The 2026 commercial real estate market is entering the year in a cautiously optimistic posture, with most major property types stabilizing or improving after a volatile 2024–2025, while a few office markets remain in later-cycle or stressed positions. The IRR 2026 Market Cycle Charts you shared for retail, office, and industrial highlight how different metros are scattered across recovery, expansion, hypersupply, and recession rather than moving in lockstep, which creates both risk and opportunity for investors and occupiers.

Big picture: cycles and capital

-

The IRR framework shows four phases—recovery, expansion, hypersupply, and recession—each defined by vacancy trends, construction levels, absorption, and rent growth.

-

Entering 2026, major research groups note that capital markets are “reawakening,” with sales volumes projected to rise 15–20% as pricing discovery improves and cross‑border and institutional capital re‑enters the space.

-

At the macro level, the base case is slower economic growth with gradually easing inflation and a more supportive rate environment, which should help transaction activity and refinancing, even if borrowing costs remain above the last cycle’s lows.

Retail: steady fundamentals, limited new supply

-

The retail cycle chart places many markets in recovery and expansion, reflecting decreasing vacancy, solid absorption, and moderate to high rent growth where new construction has been relatively muted.

-

Nationally, grocery‑anchored and neighborhood centers continue to perform particularly well, supported by healthy consumer spending and very little speculative development, leading to some of the strongest shopping center valuations in a decade outside of regional malls.

-

For investors and owners, this environment favors well‑located, experience‑or service‑oriented retail with room for mark‑to‑market rent increases, while older, commodity big‑box space remains vulnerable to retailer consolidation and bankruptcies.

Office: selective recovery and a flight to quality

-

The office cycle image shows a wide dispersion, with some metros in recovery or early expansion and others still in hypersupply or recession, underscoring how local job growth, return‑to‑office policies, and regulatory factors drive outcomes market by market.

-

Research groups now suggest that office may have found a tentative floor, with Class A, amenity‑rich buildings in prime locations approaching high occupancy and even achieving record rents, while older, undifferentiated stock struggles with high vacancy and obsolescence risk.

-

New office construction has dropped to multi‑decade lows, which should help gradually rebalance fundamentals in stronger urban and Sun Belt markets, but lenders and investors remain very selective and focused on quality, flexibility, and conversion potential.

Industrial: still the workhorse

-

The industrial chart for 2026 places many logistics‑oriented markets in recovery and expansion, showing decreasing or stable vacancies, moderate to high absorption, and ongoing rent growth, although a few metros are tipping toward late‑cycle hypersupply where development ran ahead of demand.

-

Sector performance remains closely tied to e‑commerce, reshoring, and AI‑driven demand for data‑adjacent facilities, with national outlooks calling industrial one of the more resilient property types going into 2026.

-

Construction pipelines are finally normalizing after several years of aggressive speculative building, so well‑located, modern distribution and infill industrial assets should continue to see healthy leasing and firm pricing, particularly in port, intermodal, and population‑growth markets.

What this means for strategy in 2026

-

For acquisitions and development, the expansion and early‑recovery markets on the cycle charts are where decreasing vacancy and rent growth support value creation, while hyper‑supply and recession markets favor disciplined underwriting, opportunistic buying, and asset repositioning.

-

Owners should align business plans with cycle position: focusing on lease‑up and rent mark‑ups in recovery/expansion, on cash‑flow preservation and cap‑ex discipline in hypersupply, and on capital preservation and creative workout strategies where recessionary conditions persist.

-

Across all sectors, the divide between modern, well‑located, ESG‑conscious assets and functionally obsolete properties is widening, so investors who pair market‑cycle awareness with asset‑level repositioning and active management are best positioned to capture the upside of this next phase of the cycle.

Prepared by

Andreas Senie,

Founder CRECo.ai

Managing Partner, EAC Properties LLC

Link to select list of current client needs and leads : https://eacproperties.notion.site/PUBLIC-NEEDS-LEADS-8ba7a1c1194645a790094904007e67e6