TOC: Lucrative OPPORTUNITIES - Residential BTR GP / LP INVESTMENT • AI / Fundraising / CRE News & Info • Company Capabilities

TO A SUPERIOR 2025!

FEATURED: LUCRATIVE OPPORTUNITIES

for Buyers, Lenders, Funders and Consultants – “jump on ‘em” or earn referral income

WE’LL PUBLISH YOUR OPPORTUNITY! REPLY directly in similar format

OPPORTUNITIES ABOUND

- Texas: BTR; Break ground in Q2/Q3 2026; existing loan in place; 25% ARR; year 5 sale.

- Idaho: 1) Build 4 fourplexes (16 units total); $400k, $710k retail sale EACH over 12-18 months 2) Build affordable homes; $250k investment needed; nice ROI; one home pre-sold, completion in under 6 months.

- Idaho: Acquire concrete business; $50k; expand immediately.

- Utah: 80 Apartments; 20% IRR; and more coming.

- Calif and other locations TBD: Brine Gold Mining; Geothermal Energy; seeking GPs with $500K+

Vistas at Saddleback Golf Course Project, Firestone, CO

In the last issue, we compared investing as an active General Partner vs a Limited Partner - Download Article. Let’s focus on an opportunity for some General Partners in a booming area just north of Metro Denver:

- General Partners – want 2-3 more, investing $500K+ each. Limited Partners with $100K+ are also welcome. Completing second-round $5M raise to complete preparations for construction in 2026.

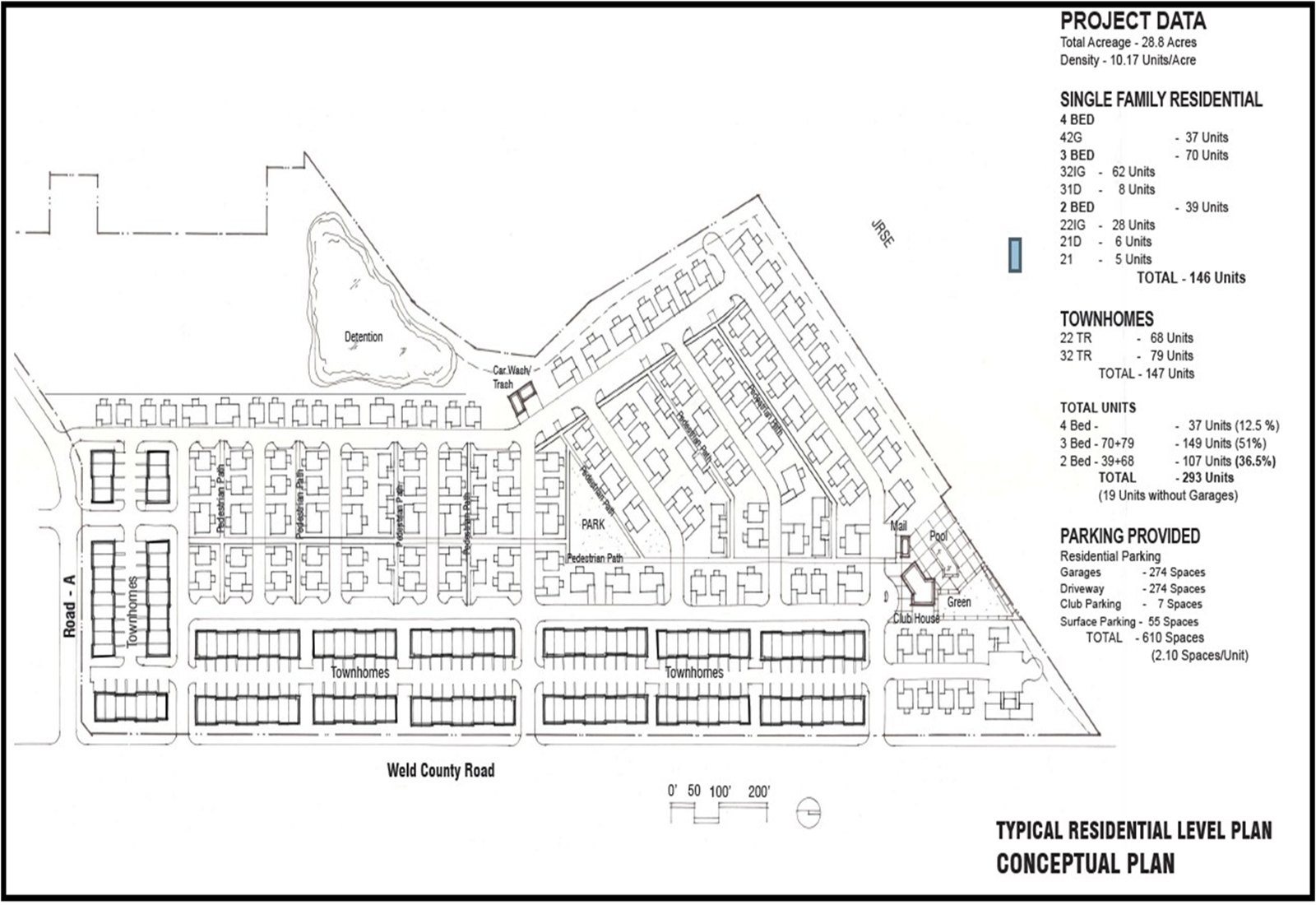

- Mixed-Use Development: A 48.5-acre community in Firestone, CO featuring 293 build-for-rent residential units on 37.5 acres, plus 4 acres of commercial space for future development

- Affordable Housing Component: Includes a 7-acre, 129-unit affordable housing project with $21M in secured grants, scheduled to begin construction in May 2026 with completion of major infrastructure

- Strategic Partnership: Collaborating with adjacent Miller United on their 28-acre parcel, who will invest $4.3M in shared infrastructure, including Grant Ave, water connections, and golf course improvements starting this fall.

- Construction Raise: $30M – possible additional GP plus LPs welcome

Source – Exec Summary (with supporting documents)

AI / BUSINESS / CRE NEWS COMMENTS

(highlights from our recent postings on LinkedIn)

WE’LL PUBLISH YOUR ARTICLE / VIDEO! REPLY directly in similar format

ARTIFICIAL INTELLIGENCE

Linas Beliūnas and Nick Bostrom. WILL AI LEAD TO FULL UNEMPLOYMENT? Summarized:

- “AI will be able to search records, documents and videos from many sources and not in databases, to find trends, patterns and connections that humans wouldn't normally find, then …

- Humans, teams and networks will key off those findings to do tasks and work faster / better and create opportunities not thought of before.

- AI may be able to coach humans, teams and networks to be even better.

- If we keep the ego and greed out of it, then the world will be a much better place.

- Look at the last 25 years for accelerated job growth for those who choose to work at it, and note that now 62% of high-school grads chose college over the 49% in 1980, meaning that higher-level workers are available.

- College and grad students are under-rated powerhouses of energy and talent, with the right coaching!" Post

- NOTE: Learn how to use AI or work – at much less pay – for those who have. See DALL-E rendition of workers processing delegated, more-manual tasks, and surrounding the most AI-savvy people who are now the Leaders (with multiple screens).

FUNDRAISING

Adam Gower. BEST UNPAID MARKETING METHODS FOR FUNDRAISING (summarized and rearranged for the acronym PLAN):

- Podcasts: Guest appearances allow you to leverage the host’s audience, with one participant raising ~$20M through interviews, enhancing reach and credibility.

- LinkedIn: Post consistently every weekday, engage with target prospects, and aim for 20–30 thoughtful comments daily to generate inbound interest.

- Authenticity: Be real and share your learning experiences; this builds trust and attracts the right investors.

- Newsletters: Send at least monthly to stay top of mind, sharing insights and updates to keep prospects engaged between funding rounds. Post

Shane Pogue. APPEARANCE MATTERS (condensed):

- Clarity Over Clutter - easy to understand.

- Consistency and Clarity – builds Credibility

- Authenticity Wins – aligned with what you bring to the table.

- Details Matter – change how others perceive your value. Post

Adding:

- Name files consistently and intelligently, starting with the Project Name(s)

- If they don't alphabetize from top down, number them as 01, 02 ..., so that 10, 11, … come in the right order, and you can insert additional files as 01.2, 01.4, …

- This shows care for the readers and attention to detail, as well as makes sure teammates, prospects and clients review in the order YOU want.

INTELLIGENT INVESTING

Brian Briscoe. INVESTMENT PHILOSOPHY EVOLUTION (summarized):

1) 5 years ago, I would have put $1 million entirely into CRE because my early investments generated triple-digit returns while the stock market underperformed. I had an "either-or" mentality due to limited capital.

2) Now I realize smart investors diversify across multiple asset classes. Since my portfolio is already real estate-heavy, I'd allocate the $1 million differently:

- Invest in my company (hire 1-2 people)

- Stock market investments

- Utah startup VC funds

3) Key insight: CRE generates my wealth, but a diversified strategy preserves and grows it. Post

Michael Bull, CCIM. OFFICE SECTOR TREND (summarized):

- Fragmented Recovery: The U.S. office market shows varied recovery, with cities like New York thriving while others like Chicago and Los Angeles struggle, highlighting a divide between urban areas.

- Rents - Nominally Stable, But Concessions Are King: While asking rents seem stable, real rents are declining, prompting landlords to offer concessions. Prime urban rents rise modestly, while older buildings lose pricing power.

- Vacancy at Record Highs: National office vacancy rates exceed 14%, with Class A buildings attracting interest while outdated structures struggle to meet tenant demands.

- Growing Value Gaps: Some office buildings sell for less than their replacement costs, offering opportunities for investors, though adaptive reuse involves high costs and complexities.

- New Supply is Plummeting: Office construction starts are at historic lows, which may rebalance the market and boost rent growth.

- Shifting Strategies: Companies are extending leases and downsizing to more efficient spaces, reevaluating location and quality trade-offs.

- Return-to-Office is Gaining Steam: Leasing activity is increasing, especially in NYC, as major companies require in-office work.

- Rising Transaction Volume: Office investment sales are up significantly, indicating strong buyer interest, although still below pre-pandemic levels.

- A Market That Rewards Skill: The office market has become an "alpha market," where strategic marketing and understanding tenant behavior create growth opportunities. Post

COMPANY CAPABILITIES

To a Great 2025! Kenton • Social Media, KentonHJohnson • Schedule Call or Mtg

NOTE: We are available for paid Board of Directors and Advisory Board positions

In 2019, we serendipitously moved from consulting Commercial Real Estate (CRE), Tech & Combo developers for 4 decades to:

- Fully structure, help prepare and deliver much-needed DEBT packages (often paid by the lender) and

- EQUITY submittals (paid by client)

- Active, knowledgeable structuring and preparation assistance

- Continuous $500K-$500M+ access & client-loan opportunities

- Deep understanding and experience in CRE & Tech -

- AEC, Development, Natural Resources, Sales and

- the myriad FINANCEoptions.biz InfoList (free, educational)

Accepting MORE Lenders prepared to use intermediaries and

Equity Sources who work with consultants

For FUNDING CANDIDATES, we do:

FREE 2-page Overview Review – focusing on mission, market, MANAGEMENT and Money™

(include supporting docs • use our short / complete NDNCA, if needed)

REFERRALS: up to 20% of the income (to 50% if you fully participate).

Use our INTRODUCTION to get 'em rollin!

Our Intro • Finance Options List • Subscription Consulting • Discounted Consulting

Excel Productivity Enhancements • Team Resume • Referral Income Schedule • LinkedIn Golden InfoNuggets